SPOILER ALERT!

Accepting Independence: The Advantages Of Senior Houses In Retired Life Communities

Posted By-Woodard Blankenship

Elderly apartment or condos in retirement communities are an excellent means for older adults to return to their roots and appreciate their retirement years. They supply an active social atmosphere and numerous amenities that can aid keep elders literally and mentally active.

elder care ma is that these living arrangements are less costly than traditional homes. This provides seniors the freedom to concentrate on the important things they enjoy most.

Senior apartments in retirement communities are created with maturing grownups in mind and supply many safety features. As an example, they usually include grab bars in bathtubs and around toilets and non-slip flooring mats on tough flooring surface areas.

Another advantage of elderly home living is that residents can anticipate a series of comforts such as housekeeping, washing and transportation solutions. These solutions can make a huge difference when it involves streamlining life and maximizing time to appreciate favored pastimes or activities.

If you're thinking about moving into an elderly home, be sure to speak with the team at Otterbein to obtain the complete image. Ideally, stay for lunch or a check out with present homeowners to obtain an accurate feeling of the neighborhood. Likewise, take into consideration how much the monthly cost contrasts to the expenses of owning and keeping a home and establish what features rest at the top of your top priority checklist. Picking a retirement community that straightens with your demands will aid you really feel much more positive in your decision.

In a retirement community, you can locate means to stay physically energetic. As an example, you can sign up with a tennis group or sign up for a woodworking class. The majority of neighborhoods additionally host occasions, which can be a wonderful means to stay gotten in touch with neighbors and explore brand-new interests.

Numerous retired life homes use housekeeping solutions and take care of upkeep, that makes it much easier to concentrate on other things. And it's very easy to track expenditures since numerous expenses are combined right into one month-to-month payment.

Plus, you're bordered by individuals who are similar. This can help you develop friendships that last, which can combat feelings of solitude and anxiety. And it can be easier to go out and about, which helps reduce health problems associated with isolation. This is why elderly homes in retirement communities remain in high need. They truly give a way of living that can make you feel young again. Just ask the residents of GreenTree at Westwood.

When you live in a senior apartment, meals are taken care of for you. You can focus your energy and time on points you enjoy to do, while additionally focusing on getting the nutrition you need.

Additionally, life in a retirement community can be more economical than living in your very own home. Frequently, there are no ahead of time entry fees and monthly rates are normally more budget friendly than maintaining your own home. And also, less expenditures implies you can proceed spending as you see fit.

If you are seeking an area to retire that can give you with the flexibility you desire, consider elderly apartment or condos in retirement communities. You can leave the yard job and home upkeep to others while still taking pleasure in a full social calendar, wellness classes and more. You will certainly have more leisure time to appreciate your pastimes, use up brand-new ones or invest quality time with liked ones. Plus, all the comforts of home are close at hand.

If you're made with handling a home upkeep schedule, spending for pricey fixings and dealing with real estate tax, you'll discover that senior houses in retirement communities use more peace of mind. With https://health.usnews.com/best-assisted-living/articles/6-factors-to-consider-when-choosing-an-assisted-living-facility , you can focus on having a good time, checking out with good friends and spoiling the grandkids!

Another excellent feature of senior apartments in retirement communities is that they're normally populated with homeowners that are your age. So, you're most likely to be bordered by people with comparable interests and experiences that share your desire for a carefree way of life.

To make it less complicated to meet brand-new good friends, think about taking advantage of your community's usual locations. You can pursue a walk around the area, head to the coffee shop or take a seat in a TV lounge to take part in tasks that enable you to interact with various other members of the community. This is a fantastic method to make new pals and build connections that can last throughout your retired life.

Elderly apartment or condos in retirement communities are an excellent means for older adults to return to their roots and appreciate their retirement years. They supply an active social atmosphere and numerous amenities that can aid keep elders literally and mentally active.

elder care ma is that these living arrangements are less costly than traditional homes. This provides seniors the freedom to concentrate on the important things they enjoy most.

1. You Get to Do What You Desire

Senior apartments in retirement communities are created with maturing grownups in mind and supply many safety features. As an example, they usually include grab bars in bathtubs and around toilets and non-slip flooring mats on tough flooring surface areas.

Another advantage of elderly home living is that residents can anticipate a series of comforts such as housekeeping, washing and transportation solutions. These solutions can make a huge difference when it involves streamlining life and maximizing time to appreciate favored pastimes or activities.

If you're thinking about moving into an elderly home, be sure to speak with the team at Otterbein to obtain the complete image. Ideally, stay for lunch or a check out with present homeowners to obtain an accurate feeling of the neighborhood. Likewise, take into consideration how much the monthly cost contrasts to the expenses of owning and keeping a home and establish what features rest at the top of your top priority checklist. Picking a retirement community that straightens with your demands will aid you really feel much more positive in your decision.

2. You Get to Keep Active

In a retirement community, you can locate means to stay physically energetic. As an example, you can sign up with a tennis group or sign up for a woodworking class. The majority of neighborhoods additionally host occasions, which can be a wonderful means to stay gotten in touch with neighbors and explore brand-new interests.

Numerous retired life homes use housekeeping solutions and take care of upkeep, that makes it much easier to concentrate on other things. And it's very easy to track expenditures since numerous expenses are combined right into one month-to-month payment.

Plus, you're bordered by individuals who are similar. This can help you develop friendships that last, which can combat feelings of solitude and anxiety. And it can be easier to go out and about, which helps reduce health problems associated with isolation. This is why elderly homes in retirement communities remain in high need. They truly give a way of living that can make you feel young again. Just ask the residents of GreenTree at Westwood.

3. You Get to Eat Well

When you live in a senior apartment, meals are taken care of for you. You can focus your energy and time on points you enjoy to do, while additionally focusing on getting the nutrition you need.

Additionally, life in a retirement community can be more economical than living in your very own home. Frequently, there are no ahead of time entry fees and monthly rates are normally more budget friendly than maintaining your own home. And also, less expenditures implies you can proceed spending as you see fit.

If you are seeking an area to retire that can give you with the flexibility you desire, consider elderly apartment or condos in retirement communities. You can leave the yard job and home upkeep to others while still taking pleasure in a full social calendar, wellness classes and more. You will certainly have more leisure time to appreciate your pastimes, use up brand-new ones or invest quality time with liked ones. Plus, all the comforts of home are close at hand.

4. You Get to Spend Even More Time With Pals

If you're made with handling a home upkeep schedule, spending for pricey fixings and dealing with real estate tax, you'll discover that senior houses in retirement communities use more peace of mind. With https://health.usnews.com/best-assisted-living/articles/6-factors-to-consider-when-choosing-an-assisted-living-facility , you can focus on having a good time, checking out with good friends and spoiling the grandkids!

Another excellent feature of senior apartments in retirement communities is that they're normally populated with homeowners that are your age. So, you're most likely to be bordered by people with comparable interests and experiences that share your desire for a carefree way of life.

To make it less complicated to meet brand-new good friends, think about taking advantage of your community's usual locations. You can pursue a walk around the area, head to the coffee shop or take a seat in a TV lounge to take part in tasks that enable you to interact with various other members of the community. This is a fantastic method to make new pals and build connections that can last throughout your retired life.

SPOILER ALERT!

Financial Preparation For Retirement Home Living: What You Required To Know

Published By-Moody Lamb

Spending for retirement community living calls for mindful economic planning. Beginning by tallying up current costs and contrasting them with prices of treatment at elderly living neighborhoods.

Long-term treatment insurance coverage (LTCI) is a popular choice for covering retirement community prices. Testimonial your policy to comprehend its terms, charges and coverage.

Making use of home equity is another typical method to finance elderly living. Nevertheless, accessing your home equity can have unforeseen repercussions.

When it comes to elderly living expenses, the earlier you begin financial planning the far better. This provides you more time to construct financial savings, financial investments, and check out various choices. A monetary advisor can aid you with the basics and complex choices, consisting of exactly how to optimize your retirement income.

Accessing home equity is a preferred way to spend for elderly living, but it is very important to evaluate the benefits and drawbacks prior to deciding. For instance, selling your residence may be much easier than leasing or obtaining a reverse home loan, however it can also affect your household's finances in the short term and minimize the quantity of living room you have.

A lot of Independent Living areas include housing, energies, dishes, housekeeping, social activities, and transportation in their costs. However, it is essential to recognize that charges usually enhance with time as the community requires to cover costs like personnel incomes, supplies, and brand-new facilities. Look for a Life Plan Community that provides a versatile charge structure like Liberty Plaza's.

Having a precise understanding of their finances is vital for elders planning to shift right into retirement community living. Start by putting together a thorough checklist of income resources and expenses, including any kind of fixed regular monthly expenses like real estate, utilities, cars and truck payments, insurance, etc and those that rise and fall from month to month, such as grocery stores, home entertainment, and medicines.

When determining their budget, seniors should also take into consideration the difference in expense between a single-family home and a retirement home. This can help them identify which alternative may fit their needs and monetary circumstance best.

When picking a community, make certain to ask about their rates framework and make note of any kind of surprise charges. A lot of communities respond to these inquiries regularly and are clear about the costs connected with their treatment. If they're not, this need to be a warning. Finally, mouse click the following article to make up tax obligations. Both entry and month-to-month charges at CCRCs that use health care are qualified for tax deductions.

One of one of the most important elements of retired life preparation is making sure that you have adequate money to cover all of your costs. One method to do this is by establishing an emergency situation interest-bearing account, which should hold about six months of living expenditures. One more method is to set up a normal transfer between your checking account and your financial investment accounts, which will make certain that you are conserving regularly.

It's also a good idea to diversify your financial investments to make sure that you can weather market disturbance. It's advised that you hold a profile that is consisted of 70% supplies and 30% bonds. If you are worried about balancing your dangers and returns, think about dealing with an economic professional to discover an approach that functions best for your needs.

Lots of elders additionally find it useful to buy long-lasting treatment insurance policy (LTCI) to cover the price of assisted living, memory care, and assisted living home care. Nonetheless, it's vital to examine LTCI plans very carefully to see to it that they cover your anticipated expenses.

Many family members pick to employ a financial organizer to aid with the preparation process. These professionals can offer expert advice on the ideas discussed over and extra, like budgeting, tax methods, and complicated decisions, such as marketing a life insurance policy policy.

Those that prepare to relocate right into a retirement home need to think about all the expenses they will certainly deal with, including real estate costs, food, services, and transport. https://zenwriting.net/dillontyron/how-to-pick-the-right-retirement-home-for-your-way-of-life will help them to determine if they can afford the living expenditures.

When comparing prices, bear in mind that not all neighborhoods charge the very same costs. Some are much more expensive than others, and the expense of senior living can differ by area. Ask neighborhoods what their prices are and make certain that they answer you honestly and transparently. If a community is not adaptable in its rates, that need to be a warning.

Spending for retirement community living calls for mindful economic planning. Beginning by tallying up current costs and contrasting them with prices of treatment at elderly living neighborhoods.

Long-term treatment insurance coverage (LTCI) is a popular choice for covering retirement community prices. Testimonial your policy to comprehend its terms, charges and coverage.

Making use of home equity is another typical method to finance elderly living. Nevertheless, accessing your home equity can have unforeseen repercussions.

Beginning Early

When it comes to elderly living expenses, the earlier you begin financial planning the far better. This provides you more time to construct financial savings, financial investments, and check out various choices. A monetary advisor can aid you with the basics and complex choices, consisting of exactly how to optimize your retirement income.

Accessing home equity is a preferred way to spend for elderly living, but it is very important to evaluate the benefits and drawbacks prior to deciding. For instance, selling your residence may be much easier than leasing or obtaining a reverse home loan, however it can also affect your household's finances in the short term and minimize the quantity of living room you have.

A lot of Independent Living areas include housing, energies, dishes, housekeeping, social activities, and transportation in their costs. However, it is essential to recognize that charges usually enhance with time as the community requires to cover costs like personnel incomes, supplies, and brand-new facilities. Look for a Life Plan Community that provides a versatile charge structure like Liberty Plaza's.

Develop a Budget

Having a precise understanding of their finances is vital for elders planning to shift right into retirement community living. Start by putting together a thorough checklist of income resources and expenses, including any kind of fixed regular monthly expenses like real estate, utilities, cars and truck payments, insurance, etc and those that rise and fall from month to month, such as grocery stores, home entertainment, and medicines.

When determining their budget, seniors should also take into consideration the difference in expense between a single-family home and a retirement home. This can help them identify which alternative may fit their needs and monetary circumstance best.

When picking a community, make certain to ask about their rates framework and make note of any kind of surprise charges. A lot of communities respond to these inquiries regularly and are clear about the costs connected with their treatment. If they're not, this need to be a warning. Finally, mouse click the following article to make up tax obligations. Both entry and month-to-month charges at CCRCs that use health care are qualified for tax deductions.

Testimonial Your Investments

One of one of the most important elements of retired life preparation is making sure that you have adequate money to cover all of your costs. One method to do this is by establishing an emergency situation interest-bearing account, which should hold about six months of living expenditures. One more method is to set up a normal transfer between your checking account and your financial investment accounts, which will make certain that you are conserving regularly.

It's also a good idea to diversify your financial investments to make sure that you can weather market disturbance. It's advised that you hold a profile that is consisted of 70% supplies and 30% bonds. If you are worried about balancing your dangers and returns, think about dealing with an economic professional to discover an approach that functions best for your needs.

Lots of elders additionally find it useful to buy long-lasting treatment insurance policy (LTCI) to cover the price of assisted living, memory care, and assisted living home care. Nonetheless, it's vital to examine LTCI plans very carefully to see to it that they cover your anticipated expenses.

Get Help

Many family members pick to employ a financial organizer to aid with the preparation process. These professionals can offer expert advice on the ideas discussed over and extra, like budgeting, tax methods, and complicated decisions, such as marketing a life insurance policy policy.

Those that prepare to relocate right into a retirement home need to think about all the expenses they will certainly deal with, including real estate costs, food, services, and transport. https://zenwriting.net/dillontyron/how-to-pick-the-right-retirement-home-for-your-way-of-life will help them to determine if they can afford the living expenditures.

When comparing prices, bear in mind that not all neighborhoods charge the very same costs. Some are much more expensive than others, and the expense of senior living can differ by area. Ask neighborhoods what their prices are and make certain that they answer you honestly and transparently. If a community is not adaptable in its rates, that need to be a warning.

SPOILER ALERT!

The Ultimate Guide To Scaling Down For Retirement Community Living

Short Article Author-Knox Long

Downsizing to a smaller home can be a liberating experience that permits even more social interactions and removes unneeded upkeep obligations. To aid with this shift, enlist the aid of family and friends, or employ professional senior scaling down services.

Rightsizing involves recognizing https://writeablog.net/yen9rosalva/the-ultimate-overview-to-choosing-the-right-retirement-community-for-your and limiting your properties to fit that room. Here are a few ideas to keep in mind during this procedure:

Downsizing can be a large task for anyone, and senior citizens are no exception. Whether they are relocating to a smaller house, a retirement community, or simply to a new living arrangement with family, downsizing can be psychologically stressful.

It's additionally a challenging time to get rid of memories and personal items. However a relocation can supply many benefits, consisting of financial savings and the capability to spend more time on tasks they delight in.

The very best method to assist your liked one conquered this barrier is by damaging the procedure right into workable parts. Service a room at once, and start with the easiest rooms first (e.g., garage, cellar). This approach will reduce tension and permit your enjoyed one to feel achieved as each space is completed.

If you're moving to a retirement community, the brand-new room might have less rooms and smaller sized floor plans than your household home. This will need you to pare down your ownerships.

Professionals recommend starting with non-sentimental items and saving sentimental ones for last. This will certainly aid you watch them fairly and minimize psychological distress if it becomes difficult to get rid of items you enjoy.

It's likewise a great concept to visit possible elderly living areas several times and to see to it you're comfortable with the dimension of the houses, the services used and the culture. Many neighborhoods use break remains so that potential homeowners can experience the lifestyle prior to making a commitment to move. This is specifically valuable when evaluating safety and access functions like expanded entrances and elevators.

Developing a downsizing strategy is an important part of the process and can help you stay on track. Experts recommend starting with the least psychological products, such as day-to-day items or clothing, and moving on to even more sentimental items like art work or furnishings.

Having a strategy will certainly additionally make the process much less stressful. Arrange your valuables right into stacks of points you will certainly maintain, give away or offer. If you need additional support, take into consideration working with a scrap removal company to lighten your load and take care of the disposal.

If there are things you want to maintain however will not fit in your brand-new home, rent a storage system. This will give you an opportunity to revisit your possessions and make a decision. If you need more assistance, enlist the assistance of family and friends who can provide an unbiased eye.

Among the most difficult elements of scaling down for retirement community living is sorting with a life time of properties. While it can be psychologically tough, there are methods to overcome this challenge.

For visit the up coming document , by working with a realty representative that has experience aiding elders downsize. This kind of agent will likely have an SRES designation (Elders Realty Professional) and can provide beneficial advice and support throughout the downsizing procedure.

Additionally, a Real estate professional can aid you select a new home that's flawlessly sized for your retirement way of living. They can additionally reveal you homes that are located near services like golf links, dining establishments, and grocery stores. This can make the change into a smaller living space a lot easier and a lot more satisfying. And also, it can allow you to live closer to member of the family and get aid with health and wellness problems as you age.

For some seniors, scaling down is an emotionally filled procedure. They may have strong psychological ties to their current home, or be stressed over the expenses of maintaining a huge residential property.

The other difficulty is that senior living neighborhoods have much more restricted area, so it can be tough to identify what furnishings and valuables will certainly fit pleasantly. As a result, it is essential to start early, and start by decluttering areas that have no nostalgic add-on.

This methodical method can aid prevent the project from really feeling overwhelming. Downsizing experts suggest starting with an utility room, mudroom, or cupboard and functioning your method approximately bigger areas such as cellars, attics, garages, and bedrooms. By beginning with a smaller area, it's simpler to concentrate on the job available and not get bogged down by emotion or procrastination.

Downsizing to a smaller home can be a liberating experience that permits even more social interactions and removes unneeded upkeep obligations. To aid with this shift, enlist the aid of family and friends, or employ professional senior scaling down services.

Rightsizing involves recognizing https://writeablog.net/yen9rosalva/the-ultimate-overview-to-choosing-the-right-retirement-community-for-your and limiting your properties to fit that room. Here are a few ideas to keep in mind during this procedure:

1. Understand Your Motivations

Downsizing can be a large task for anyone, and senior citizens are no exception. Whether they are relocating to a smaller house, a retirement community, or simply to a new living arrangement with family, downsizing can be psychologically stressful.

It's additionally a challenging time to get rid of memories and personal items. However a relocation can supply many benefits, consisting of financial savings and the capability to spend more time on tasks they delight in.

The very best method to assist your liked one conquered this barrier is by damaging the procedure right into workable parts. Service a room at once, and start with the easiest rooms first (e.g., garage, cellar). This approach will reduce tension and permit your enjoyed one to feel achieved as each space is completed.

2. Assess Your Requirements

If you're moving to a retirement community, the brand-new room might have less rooms and smaller sized floor plans than your household home. This will need you to pare down your ownerships.

Professionals recommend starting with non-sentimental items and saving sentimental ones for last. This will certainly aid you watch them fairly and minimize psychological distress if it becomes difficult to get rid of items you enjoy.

It's likewise a great concept to visit possible elderly living areas several times and to see to it you're comfortable with the dimension of the houses, the services used and the culture. Many neighborhoods use break remains so that potential homeowners can experience the lifestyle prior to making a commitment to move. This is specifically valuable when evaluating safety and access functions like expanded entrances and elevators.

3. Produce a Plan

Developing a downsizing strategy is an important part of the process and can help you stay on track. Experts recommend starting with the least psychological products, such as day-to-day items or clothing, and moving on to even more sentimental items like art work or furnishings.

Having a strategy will certainly additionally make the process much less stressful. Arrange your valuables right into stacks of points you will certainly maintain, give away or offer. If you need additional support, take into consideration working with a scrap removal company to lighten your load and take care of the disposal.

If there are things you want to maintain however will not fit in your brand-new home, rent a storage system. This will give you an opportunity to revisit your possessions and make a decision. If you need more assistance, enlist the assistance of family and friends who can provide an unbiased eye.

4. Hire a Realtor

Among the most difficult elements of scaling down for retirement community living is sorting with a life time of properties. While it can be psychologically tough, there are methods to overcome this challenge.

For visit the up coming document , by working with a realty representative that has experience aiding elders downsize. This kind of agent will likely have an SRES designation (Elders Realty Professional) and can provide beneficial advice and support throughout the downsizing procedure.

Additionally, a Real estate professional can aid you select a new home that's flawlessly sized for your retirement way of living. They can additionally reveal you homes that are located near services like golf links, dining establishments, and grocery stores. This can make the change into a smaller living space a lot easier and a lot more satisfying. And also, it can allow you to live closer to member of the family and get aid with health and wellness problems as you age.

5. Start Early

For some seniors, scaling down is an emotionally filled procedure. They may have strong psychological ties to their current home, or be stressed over the expenses of maintaining a huge residential property.

The other difficulty is that senior living neighborhoods have much more restricted area, so it can be tough to identify what furnishings and valuables will certainly fit pleasantly. As a result, it is essential to start early, and start by decluttering areas that have no nostalgic add-on.

This methodical method can aid prevent the project from really feeling overwhelming. Downsizing experts suggest starting with an utility room, mudroom, or cupboard and functioning your method approximately bigger areas such as cellars, attics, garages, and bedrooms. By beginning with a smaller area, it's simpler to concentrate on the job available and not get bogged down by emotion or procrastination.

SPOILER ALERT!

Healthy And Balanced Aging: Health Programs Offered In Retired Life Communities

Created By-Nielsen Blair

A crucial goal of senior wellness programs is maintaining elders informed of preventative treatment and health care. This consists of whatever from annual flu shots to taking their medications as guided by a medical professional.

Another emphasis gets on cognitive wellness. Tasks like computer system seminars and language lessons involve different parts of the mind, helping residents preserve or enhance their mental acuity.

Exercise is a crucial part of a healthy way of life for people of any type of age, however it's even more crucial for elders. Routine exercise aids with strength, equilibrium and flexibility. It can additionally help reduce stress and anxiety and increase the immune system.

https://zenwriting.net/calandra13hannah/retirement-home-vs-aging-in-position-making-the-most-effective-selection-for living neighborhoods provide some type of wellness shows for citizens, yet the best ones offer more than simply physical conditioning activities. They integrate ways for senior citizens to socialize with each other. They may organize occasions at neighborhood coastlines, dining establishments or museums, and they encourage strolling by preserving top quality paths and walkways.

Several neighborhoods utilize innovative methods to get seniors relocating and engaged, consisting of shinrin-yoku "forest showering" (taking in the fragrance of evergreen trees), yoga exercise and tai chi. These ancient techniques have been revealed to reduce stress and anxiety, improve equilibrium and strengthen the heart. They can be done independently or in teams and are adjusted to fit any type of capacity.

Taking the appropriate vitamins and nutrients is necessary for healthy and balanced aging. Nutritional programs in retirement communities can provide elders with access to nourishing dishes and info on just how to make the very best choices regarding their diet regimens.

Having routine social interaction is likewise important to healthy aging, and retirement community health care usually consist of possibilities to satisfy new people or remain to enjoy activities with buddies and colleagues. Courses such as ceramics or paint, offering for a reason and signing up with a book club are all great means to stay participated in the community and build solid connections.

The most recent modern technologies are also being presented right into retirement home health care. Fitness trackers and virtual reality exercises can help locals to remain healthy, and modern technology like telemedicine is helping to maintain senior citizens linked to their medical professionals even after they move into retired life living. This helps to promote the health and wellness of citizens and lower healthcare facility admissions and readmissions. When a senior has a clinical requirement, a skilled registered nurse can link them to healthcare providers to manage their problem from another location.

Socializing offers an electrical outlet for emotional support and a feeling of belonging. Research studies show that solitude and seclusion raise the risk of psychological health disorders, such as anxiety and anxiousness.

Seniors that stay in retirement communities have a range of means to socialize, consisting of workout courses and once a week spiritual solutions. In addition, many retirement communities provide volunteer possibilities for citizens that wish to give back to the community. This can include offering dishes at regional soup kitchens, mentoring young pupils or offering health campaigning for.

For elders who locate barriers to interacting socially, such as physical conditions or COVID-19 concern, senior-focused programs and solutions are readily available throughout the City and State. NYAM's Facility for Healthy and balanced Aging operates at the City and State degrees to ask older New Yorkers regarding their daily lives, identify challenges they encounter and develop methods to decrease or remove these barriers so that they can enhance social, physical and economic engagement. Find out more about our work, resources and magazines in the Center for Healthy and balanced Aging microsite.

Whether seniors have had a lengthy spiritual journey or discovered religious beliefs later in life, the sense of area and peace that features faith can be extremely helpful for healthy aging. Spirituality supplies a strong foundation to draw on when life's difficulties present themselves, such as retirement, loss of independence, or modifications in lifestyle.

It also helps fight the common risk of seclusion that can bring about physical troubles such as hypertension, cardiovascular disease, excessive weight, weak immune system, and clinical depression. assisted living west springfield ma , such as prayer, meditation, and going to religious services, foster social connection with similar individuals and motivate a positive overview.

Scientists are working to understand exactly how these spiritual ideas and techniques can contribute to much better health and wellness results in older grownups. They want to make use of new survey examinations that focus on everyday spiritual experiences, personal religious methods, and beliefs and worths instead of simply church presence, which may have been a restriction of earlier researches.

A crucial goal of senior wellness programs is maintaining elders informed of preventative treatment and health care. This consists of whatever from annual flu shots to taking their medications as guided by a medical professional.

Another emphasis gets on cognitive wellness. Tasks like computer system seminars and language lessons involve different parts of the mind, helping residents preserve or enhance their mental acuity.

Workout

Exercise is a crucial part of a healthy way of life for people of any type of age, however it's even more crucial for elders. Routine exercise aids with strength, equilibrium and flexibility. It can additionally help reduce stress and anxiety and increase the immune system.

https://zenwriting.net/calandra13hannah/retirement-home-vs-aging-in-position-making-the-most-effective-selection-for living neighborhoods provide some type of wellness shows for citizens, yet the best ones offer more than simply physical conditioning activities. They integrate ways for senior citizens to socialize with each other. They may organize occasions at neighborhood coastlines, dining establishments or museums, and they encourage strolling by preserving top quality paths and walkways.

Several neighborhoods utilize innovative methods to get seniors relocating and engaged, consisting of shinrin-yoku "forest showering" (taking in the fragrance of evergreen trees), yoga exercise and tai chi. These ancient techniques have been revealed to reduce stress and anxiety, improve equilibrium and strengthen the heart. They can be done independently or in teams and are adjusted to fit any type of capacity.

Nourishment

Taking the appropriate vitamins and nutrients is necessary for healthy and balanced aging. Nutritional programs in retirement communities can provide elders with access to nourishing dishes and info on just how to make the very best choices regarding their diet regimens.

Having routine social interaction is likewise important to healthy aging, and retirement community health care usually consist of possibilities to satisfy new people or remain to enjoy activities with buddies and colleagues. Courses such as ceramics or paint, offering for a reason and signing up with a book club are all great means to stay participated in the community and build solid connections.

The most recent modern technologies are also being presented right into retirement home health care. Fitness trackers and virtual reality exercises can help locals to remain healthy, and modern technology like telemedicine is helping to maintain senior citizens linked to their medical professionals even after they move into retired life living. This helps to promote the health and wellness of citizens and lower healthcare facility admissions and readmissions. When a senior has a clinical requirement, a skilled registered nurse can link them to healthcare providers to manage their problem from another location.

Socializing

Socializing offers an electrical outlet for emotional support and a feeling of belonging. Research studies show that solitude and seclusion raise the risk of psychological health disorders, such as anxiety and anxiousness.

Seniors that stay in retirement communities have a range of means to socialize, consisting of workout courses and once a week spiritual solutions. In addition, many retirement communities provide volunteer possibilities for citizens that wish to give back to the community. This can include offering dishes at regional soup kitchens, mentoring young pupils or offering health campaigning for.

For elders who locate barriers to interacting socially, such as physical conditions or COVID-19 concern, senior-focused programs and solutions are readily available throughout the City and State. NYAM's Facility for Healthy and balanced Aging operates at the City and State degrees to ask older New Yorkers regarding their daily lives, identify challenges they encounter and develop methods to decrease or remove these barriers so that they can enhance social, physical and economic engagement. Find out more about our work, resources and magazines in the Center for Healthy and balanced Aging microsite.

Spirituality

Whether seniors have had a lengthy spiritual journey or discovered religious beliefs later in life, the sense of area and peace that features faith can be extremely helpful for healthy aging. Spirituality supplies a strong foundation to draw on when life's difficulties present themselves, such as retirement, loss of independence, or modifications in lifestyle.

It also helps fight the common risk of seclusion that can bring about physical troubles such as hypertension, cardiovascular disease, excessive weight, weak immune system, and clinical depression. assisted living west springfield ma , such as prayer, meditation, and going to religious services, foster social connection with similar individuals and motivate a positive overview.

Scientists are working to understand exactly how these spiritual ideas and techniques can contribute to much better health and wellness results in older grownups. They want to make use of new survey examinations that focus on everyday spiritual experiences, personal religious methods, and beliefs and worths instead of simply church presence, which may have been a restriction of earlier researches.

SPOILER ALERT!

The Ultimate Overview To Downsizing For Retirement Community Living

Content Writer-Burch McCall

Scaling down to a smaller home can be a liberating experience that enables even more social communications and removes unnecessary maintenance obligations. To assist with this transition, employ the aid of family and friends, or hire specialist senior downsizing solutions.

Rightsizing involves understanding your demands and limiting your possessions to fit that room. Here are a few ideas to remember throughout this procedure:

Downsizing can be a big undertaking for anyone, and elders are no exception. Whether they are moving to a smaller sized home, a retirement community, or just to a new living setup with family, scaling down can be emotionally difficult.

It's additionally a hard time to part with memories and personal possessions. However an action can give many advantages, including economic cost savings and the capability to invest more time on tasks they enjoy.

The most effective means to assist your loved one conquered this challenge is by damaging the procedure right into manageable sections. Service a space at once, and begin with the simplest spaces first (e.g., garage, cellar). This strategy will certainly reduce stress and anxiety and allow your enjoyed one to feel established as each room is completed.

If you're relocating to a retirement home, the new space might have less areas and smaller sized layout than your household home. This will certainly require you to pare down your belongings.

Experts suggest starting with non-sentimental items and saving emotional ones for last. https://zenwriting.net/jenniffer03miles/retirement-home-vs-aging-in-place-making-the-best-option-for-your-future will assist you watch them fairly and decrease emotional distress if it ends up being challenging to part with things you enjoy.

It's also a good idea to see possible elderly living communities numerous times and to make sure you fit with the dimension of the apartment or condos, the features provided and the society. Several neighborhoods offer break remains to ensure that possible locals can experience the way of living prior to making a dedication to relocate. This is especially practical when evaluating safety and security and access attributes like widened doorways and lifts.

Creating a downsizing strategy is an essential part of the procedure and can aid you stay on track. Professionals advise beginning with the least emotional things, such as day-to-day items or garments, and carrying on to even more emotional pieces like art work or furniture.

Having a strategy will additionally make the procedure much less demanding. Arrange your items into heaps of things you will maintain, donate or market. If you require extra assistance, think about working with a junk removal business to lighten your tons and deal with the disposal.

If there are items you want to maintain yet won't fit in your brand-new home, rent out a storage space device. This will certainly provide you an opportunity to revisit your possessions and make a decision. If you need more help, get the assistance of family and friends that can offer an objective eye.

One of one of the most difficult aspects of scaling down for retirement home living is sorting via a lifetime of belongings. While it can be psychologically challenging, there are ways to conquer this difficulty.

For example, by employing a property representative who has experience helping seniors downsize. This kind of agent will likely have an SRES designation (Senior citizens Property Professional) and can give important recommendations and advice throughout the downsizing procedure.

Additionally, a Real estate professional can assist you select a brand-new home that's flawlessly sized for your retired life way of living. They can also reveal you homes that lie near services like fairway, restaurants, and food store. This can make the transition right into a smaller space a lot easier and extra satisfying. Plus, it can enable you to live closer to member of the family and obtain assist with health and wellness issues as you age.

For some elders, downsizing is a mentally filled procedure. straight from the source might have solid emotional ties to their existing home, or be fretted about the costs of maintaining a large residential or commercial property.

The various other challenge is that senior living neighborhoods have a lot more limited area, so it can be challenging to determine what furniture and personal belongings will certainly fit conveniently. Therefore, it is very important to start early, and begin by decluttering rooms that have no emotional attachment.

This systematic method can help protect against the job from really feeling overwhelming. Scaling down specialists suggest starting with a laundry room, mudroom, or pantry and functioning your way approximately larger areas such as cellars, attics, garages, and bedrooms. By beginning with a smaller location, it's much easier to concentrate on the job handy and not obtain bogged down by emotion or procrastination.

Scaling down to a smaller home can be a liberating experience that enables even more social communications and removes unnecessary maintenance obligations. To assist with this transition, employ the aid of family and friends, or hire specialist senior downsizing solutions.

Rightsizing involves understanding your demands and limiting your possessions to fit that room. Here are a few ideas to remember throughout this procedure:

1. Understand Your Motivations

Downsizing can be a big undertaking for anyone, and elders are no exception. Whether they are moving to a smaller sized home, a retirement community, or just to a new living setup with family, scaling down can be emotionally difficult.

It's additionally a hard time to part with memories and personal possessions. However an action can give many advantages, including economic cost savings and the capability to invest more time on tasks they enjoy.

The most effective means to assist your loved one conquered this challenge is by damaging the procedure right into manageable sections. Service a space at once, and begin with the simplest spaces first (e.g., garage, cellar). This strategy will certainly reduce stress and anxiety and allow your enjoyed one to feel established as each room is completed.

2. Examine Your Needs

If you're relocating to a retirement home, the new space might have less areas and smaller sized layout than your household home. This will certainly require you to pare down your belongings.

Experts suggest starting with non-sentimental items and saving emotional ones for last. https://zenwriting.net/jenniffer03miles/retirement-home-vs-aging-in-place-making-the-best-option-for-your-future will assist you watch them fairly and decrease emotional distress if it ends up being challenging to part with things you enjoy.

It's also a good idea to see possible elderly living communities numerous times and to make sure you fit with the dimension of the apartment or condos, the features provided and the society. Several neighborhoods offer break remains to ensure that possible locals can experience the way of living prior to making a dedication to relocate. This is especially practical when evaluating safety and security and access attributes like widened doorways and lifts.

3. Develop a Strategy

Creating a downsizing strategy is an essential part of the procedure and can aid you stay on track. Professionals advise beginning with the least emotional things, such as day-to-day items or garments, and carrying on to even more emotional pieces like art work or furniture.

Having a strategy will additionally make the procedure much less demanding. Arrange your items into heaps of things you will maintain, donate or market. If you require extra assistance, think about working with a junk removal business to lighten your tons and deal with the disposal.

If there are items you want to maintain yet won't fit in your brand-new home, rent out a storage space device. This will certainly provide you an opportunity to revisit your possessions and make a decision. If you need more help, get the assistance of family and friends that can offer an objective eye.

4. Hire a Realtor

One of one of the most difficult aspects of scaling down for retirement home living is sorting via a lifetime of belongings. While it can be psychologically challenging, there are ways to conquer this difficulty.

For example, by employing a property representative who has experience helping seniors downsize. This kind of agent will likely have an SRES designation (Senior citizens Property Professional) and can give important recommendations and advice throughout the downsizing procedure.

Additionally, a Real estate professional can assist you select a brand-new home that's flawlessly sized for your retired life way of living. They can also reveal you homes that lie near services like fairway, restaurants, and food store. This can make the transition right into a smaller space a lot easier and extra satisfying. Plus, it can enable you to live closer to member of the family and obtain assist with health and wellness issues as you age.

5. Begin Early

For some elders, downsizing is a mentally filled procedure. straight from the source might have solid emotional ties to their existing home, or be fretted about the costs of maintaining a large residential or commercial property.

The various other challenge is that senior living neighborhoods have a lot more limited area, so it can be challenging to determine what furniture and personal belongings will certainly fit conveniently. Therefore, it is very important to start early, and begin by decluttering rooms that have no emotional attachment.

This systematic method can help protect against the job from really feeling overwhelming. Scaling down specialists suggest starting with a laundry room, mudroom, or pantry and functioning your way approximately larger areas such as cellars, attics, garages, and bedrooms. By beginning with a smaller location, it's much easier to concentrate on the job handy and not obtain bogged down by emotion or procrastination.

SPOILER ALERT!

Checking Out Various Sorts Of Retirement Communities: Searching For Your Perfect Fit

Posted By-Lund Beard

Like finding the excellent fit of clothing, locating the best retirement home will entail some trial and error. But if you keep trying, you'll ultimately find the perfect suit.

Check out all the housing options a retirement home uses, including their regular monthly costs and any kind of entrance charges. When you go to, ask homeowners about their experiences and what they delight in most about the community.

For senior citizens that wish to take pleasure in life without the job of preserving a home, independent living neighborhoods provide a range of features. These array from exercise courses to beauty parlor solutions to proceeding education and art workshops. Many additionally have social gatherings and expeditions.

Depending on https://writeablog.net/levi91chang/the-ultimate-overview-to-choosing-the-right-retirement-community-for-your-way of retirement home, it is necessary to consider what takes place if you or your enjoyed one requires additional treatment in the future. Make a list of the services and features that are crucial to you, then visit those types of facilities to see if they will certainly meet your needs.

Additionally, make sure to ask what transport choices the center uses. If you or your liked one sheds their capacity to drive, maybe testing to pursue social activities, shop and keep doctor's appointments. The good news is, both retirement and Life Strategy communities typically give a range of onsite transport alternatives. Sometimes, entryway fees are refundable if you or your loved one ever requires them.

Whether it results from physical wellness problems or just tired of raking leaves and cooking, many older adults discover they need added help with everyday living. skilled nursing facility 's when thinking about assisted living comes to be an option.

When touring assisted living communities, consider the design of the personal residences. Ask about furnishings choices (can residents bring their own), what types of home appliances they can have in the home, and if guests rate overnight. You additionally wish to find out more regarding the available services, such as if restrooms are developed with security functions like grab bars and if there are accessible areas to walk both indoors and outdoors.

Another point to check out is the staff. Learn about their certifications and turn over prices and if history checks are conducted. And do not fail to remember to inquire about expenses and contracts! The best community can aid you remain to live individually while getting the treatment and support you need. It might also be partly covered by Medicare or long-lasting treatment insurance coverage.

Memory care communities give the same services as long-term care communities yet have specialized services and a focus on helping senior citizens with mental deterioration. They offer 24/7 treatment, with staff members having specialized training in dealing with those that have amnesia or mental deterioration and occasionally higher qualifications like nursing qualifications. Along with this, they frequently have attributes like color-coated corridors, easy-to-navigate layout, safety measures on doors and elevators, covered thresholds, softer flooring and more.

When visiting https://www.aarp.org/caregiving/basics/info-2020/geriatric-care-manager.html , ask about the staff-to-resident proportion during the day and night, and how they are trained to handle emergencies, suggests Eichenberger. Likewise, make certain they have the correct licensing and accreditation, and ask about pricing frameworks and additional costs. Ultimately, it's important to see and observe their homeowners and see how they connect with each other. This will certainly offer you a concept of exactly how comfy they'll really feel at the area.

Sometimes seniors need knowledgeable nursing like handle their chronic illness or recoup from surgical treatment. Proficient nursing facilities, additionally known as retirement home or SNFs, are regulated by the Centers for Medicare and Medicaid Solutions (CMS) and Division of Public Health and periodically checked to ensure top notch criteria.

Unlike a health center, nursing homes have a reduced staff-to-patient ratio and a much more home setting. They additionally provide a wide variety of rehab and restorative solutions, including physical therapy and occupational therapy, speech therapy and injury treatment.

Some assisted living areas have a competent nursing program that allows elders to receive continuous medical care without being rooted out from their area. When examining alternatives, make certain to search for this choice and check whether it is covered by your elderly loved one's long-lasting care insurance policy. Furthermore, see to it to explore the facility personally-- you'll be able to see firsthand just how well the residents and team communicate.

Like finding the excellent fit of clothing, locating the best retirement home will entail some trial and error. But if you keep trying, you'll ultimately find the perfect suit.

Check out all the housing options a retirement home uses, including their regular monthly costs and any kind of entrance charges. When you go to, ask homeowners about their experiences and what they delight in most about the community.

1. Independent Living

For senior citizens that wish to take pleasure in life without the job of preserving a home, independent living neighborhoods provide a range of features. These array from exercise courses to beauty parlor solutions to proceeding education and art workshops. Many additionally have social gatherings and expeditions.

Depending on https://writeablog.net/levi91chang/the-ultimate-overview-to-choosing-the-right-retirement-community-for-your-way of retirement home, it is necessary to consider what takes place if you or your enjoyed one requires additional treatment in the future. Make a list of the services and features that are crucial to you, then visit those types of facilities to see if they will certainly meet your needs.

Additionally, make sure to ask what transport choices the center uses. If you or your liked one sheds their capacity to drive, maybe testing to pursue social activities, shop and keep doctor's appointments. The good news is, both retirement and Life Strategy communities typically give a range of onsite transport alternatives. Sometimes, entryway fees are refundable if you or your loved one ever requires them.

2. Aided Living

Whether it results from physical wellness problems or just tired of raking leaves and cooking, many older adults discover they need added help with everyday living. skilled nursing facility 's when thinking about assisted living comes to be an option.

When touring assisted living communities, consider the design of the personal residences. Ask about furnishings choices (can residents bring their own), what types of home appliances they can have in the home, and if guests rate overnight. You additionally wish to find out more regarding the available services, such as if restrooms are developed with security functions like grab bars and if there are accessible areas to walk both indoors and outdoors.

Another point to check out is the staff. Learn about their certifications and turn over prices and if history checks are conducted. And do not fail to remember to inquire about expenses and contracts! The best community can aid you remain to live individually while getting the treatment and support you need. It might also be partly covered by Medicare or long-lasting treatment insurance coverage.

3. Memory Care

Memory care communities give the same services as long-term care communities yet have specialized services and a focus on helping senior citizens with mental deterioration. They offer 24/7 treatment, with staff members having specialized training in dealing with those that have amnesia or mental deterioration and occasionally higher qualifications like nursing qualifications. Along with this, they frequently have attributes like color-coated corridors, easy-to-navigate layout, safety measures on doors and elevators, covered thresholds, softer flooring and more.

When visiting https://www.aarp.org/caregiving/basics/info-2020/geriatric-care-manager.html , ask about the staff-to-resident proportion during the day and night, and how they are trained to handle emergencies, suggests Eichenberger. Likewise, make certain they have the correct licensing and accreditation, and ask about pricing frameworks and additional costs. Ultimately, it's important to see and observe their homeowners and see how they connect with each other. This will certainly offer you a concept of exactly how comfy they'll really feel at the area.

4. Skilled Nursing

Sometimes seniors need knowledgeable nursing like handle their chronic illness or recoup from surgical treatment. Proficient nursing facilities, additionally known as retirement home or SNFs, are regulated by the Centers for Medicare and Medicaid Solutions (CMS) and Division of Public Health and periodically checked to ensure top notch criteria.

Unlike a health center, nursing homes have a reduced staff-to-patient ratio and a much more home setting. They additionally provide a wide variety of rehab and restorative solutions, including physical therapy and occupational therapy, speech therapy and injury treatment.

Some assisted living areas have a competent nursing program that allows elders to receive continuous medical care without being rooted out from their area. When examining alternatives, make certain to search for this choice and check whether it is covered by your elderly loved one's long-lasting care insurance policy. Furthermore, see to it to explore the facility personally-- you'll be able to see firsthand just how well the residents and team communicate.

SPOILER ALERT!

Retirement Community Vs Aging In Place: Making The Most Effective Choice For Your Future

Short Article Composed By-Monahan Grantham

The concept of your moms and dads staying in their homes as they age noises terrific. This way, they get to proceed residing in their comfortable neighborhoods and maintain long-term friendships.

Nonetheless, https://www.aarp.org/caregiving/home-care/info-2019/safety-tips.html is not without its challenges. It is essential to take into consideration both the pros and cons of aging in position to choose whether it is the very best choice for you.

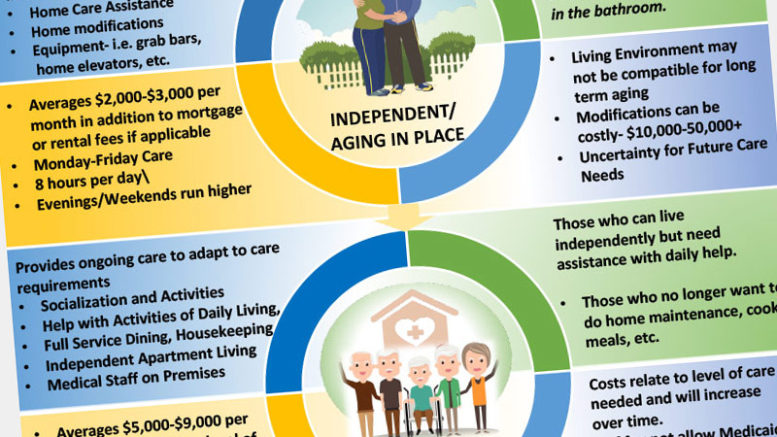

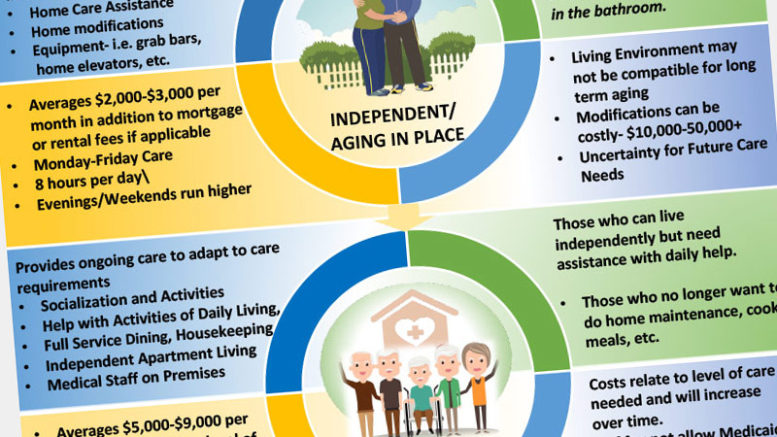

In a lot of cases, maturing in place is an economically audio choice. Yet the fact is that it comes with its own collection of expenses.

As an example, the cost of employing someone to help with day-to-day family tasks and duties can rapidly accumulate. In addition, changing a home to meet transforming needs can be pricey also-- specifically for a larger home that might need wheelchair ramps or broader doors and hallways.

The good news is that there are ways to alleviate these expenses if you choose to age in position. For example, you can lower your prices by downsizing to a smaller home or perhaps a condominium within a retirement home that uses treatment services. Those neighborhoods also provide low or no entrance charges, and their regular monthly prices are extra affordable than conventional long-term treatment centers. Some offer a lifecare agreement, where your monthly cost covers future treatment needs as they occur. Other retirement home operate a fee-for-service model.

Many elders wish to age in place since they feel a solid emotional connection to their home. However, this decision can be complicated by health and wellness and mobility worries that require a household to take into consideration other alternatives.

In a retirement home, older grownups can fraternize other locals. This can have significant advantages for their psychological and physical health. Research studies have actually revealed that people that socialize and maintain healthy and balanced connections tend to have lower prices of anxiety and greater levels of useful self-reliance.

If a person's health decreases, they can change to a greater level of treatment at a retirement home. They will not have to leave the buddies and personnel they know. This option is additionally good for couples who are both seeking treatment but intend to stay together. However, it is very important to understand that this sort of retirement home needs a bigger upfront entrance charge. This can make it challenging for some households to manage.

Leaving your current home and moving into a retirement community is a large decision. It might feel permanent, specifically if you are called for to pay a buy-in fee or have actually limited movement or health and wellness concerns.

However, retirement communities provide a setting that looks after many upkeep duties and can consist of health care solutions from registered nurses and assistants to specialized memory treatment devices. On top of that, many communities provide amenities such as swimming pools, walking trails, and vibrant occasions.

The downside to aging in place is that the familiarity of your own home can cause sensations of seclusion, and it can be challenging to discover methods of transportation to leave your house, along with to fraternize various other senior citizens. Prices for home adjustments, caregivers, and health care services can additionally accumulate promptly. Picking which option best suits your way of living, requires, and budget plan is essential. It might be worth speaking with household, buddies, and specialists in senior like review your distinct scenario and make an enlightened selection.

Aging in position entails living in an acquainted, comfy home. It can be an excellent option if you remain in healthiness and do not require help with everyday tasks. Nonetheless, you'll require to see to it your home is established for safety and security, consisting of non-slip floor surface areas and grab bars in restrooms. You'll likewise require to have relative or good friends nearby that can aid you if required.

Familiar environments use comfort and can foster a psychological accessory to a location. Nevertheless, if you become too frail to care for on your own, you might need to move into an assisted living facility or assisted living center. This can be a stressful shift, specifically if it comes all of a sudden.

Retirement home supply a balance between treatment and independence, with choices for various degrees helpful as your demands change. These neighborhoods typically have on-site experienced nursing centers, which can remove the requirement to relocate when you need even more care. This can lower the stress of transitioning and supply comfort.

The concept of your moms and dads staying in their homes as they age noises terrific. This way, they get to proceed residing in their comfortable neighborhoods and maintain long-term friendships.

Nonetheless, https://www.aarp.org/caregiving/home-care/info-2019/safety-tips.html is not without its challenges. It is essential to take into consideration both the pros and cons of aging in position to choose whether it is the very best choice for you.

Price

In a lot of cases, maturing in place is an economically audio choice. Yet the fact is that it comes with its own collection of expenses.

As an example, the cost of employing someone to help with day-to-day family tasks and duties can rapidly accumulate. In addition, changing a home to meet transforming needs can be pricey also-- specifically for a larger home that might need wheelchair ramps or broader doors and hallways.

The good news is that there are ways to alleviate these expenses if you choose to age in position. For example, you can lower your prices by downsizing to a smaller home or perhaps a condominium within a retirement home that uses treatment services. Those neighborhoods also provide low or no entrance charges, and their regular monthly prices are extra affordable than conventional long-term treatment centers. Some offer a lifecare agreement, where your monthly cost covers future treatment needs as they occur. Other retirement home operate a fee-for-service model.

Socializing

Many elders wish to age in place since they feel a solid emotional connection to their home. However, this decision can be complicated by health and wellness and mobility worries that require a household to take into consideration other alternatives.

In a retirement home, older grownups can fraternize other locals. This can have significant advantages for their psychological and physical health. Research studies have actually revealed that people that socialize and maintain healthy and balanced connections tend to have lower prices of anxiety and greater levels of useful self-reliance.

If a person's health decreases, they can change to a greater level of treatment at a retirement home. They will not have to leave the buddies and personnel they know. This option is additionally good for couples who are both seeking treatment but intend to stay together. However, it is very important to understand that this sort of retirement home needs a bigger upfront entrance charge. This can make it challenging for some households to manage.

Security

Leaving your current home and moving into a retirement community is a large decision. It might feel permanent, specifically if you are called for to pay a buy-in fee or have actually limited movement or health and wellness concerns.

However, retirement communities provide a setting that looks after many upkeep duties and can consist of health care solutions from registered nurses and assistants to specialized memory treatment devices. On top of that, many communities provide amenities such as swimming pools, walking trails, and vibrant occasions.

The downside to aging in place is that the familiarity of your own home can cause sensations of seclusion, and it can be challenging to discover methods of transportation to leave your house, along with to fraternize various other senior citizens. Prices for home adjustments, caregivers, and health care services can additionally accumulate promptly. Picking which option best suits your way of living, requires, and budget plan is essential. It might be worth speaking with household, buddies, and specialists in senior like review your distinct scenario and make an enlightened selection.

Healthcare

Aging in position entails living in an acquainted, comfy home. It can be an excellent option if you remain in healthiness and do not require help with everyday tasks. Nonetheless, you'll require to see to it your home is established for safety and security, consisting of non-slip floor surface areas and grab bars in restrooms. You'll likewise require to have relative or good friends nearby that can aid you if required.

Familiar environments use comfort and can foster a psychological accessory to a location. Nevertheless, if you become too frail to care for on your own, you might need to move into an assisted living facility or assisted living center. This can be a stressful shift, specifically if it comes all of a sudden.

Retirement home supply a balance between treatment and independence, with choices for various degrees helpful as your demands change. These neighborhoods typically have on-site experienced nursing centers, which can remove the requirement to relocate when you need even more care. This can lower the stress of transitioning and supply comfort.

SPOILER ALERT!

Selecting Between Assisted Living As Well As Independent Living Areas

Authored by-Locklear Pena

The National Facility for Assisted Living suggests seeing several assisted living facilities to establish if a certain area is right for your enjoyed one. Checking out throughout https://www.iadvanceseniorcare.com/creative-ideas-for-marketing-senior-care-facilities-during-the-pandemic/ is a great means to satisfy the team and also citizens of the facility. If you have inquiries, make sure to ask. Additionally, do not be reluctant regarding requesting referrals or to see the centers' website. This info is essential to the decision-making procedure. By complying with these pointers, you can ensure that you will obtain a high quality aided living experience.

Among the primary distinctions between assisted living and independent living is the variety of solutions offered. While some assisted living communities offer some medical help, they are not as comprehensive as experienced nursing communities. These are typically developed for senior citizens with an extra serious medical condition. You can anticipate 24-hour care in a proficient nursing area, and there are likewise extra benefits that come with this kind of care. Yet you need to still research your alternatives very carefully prior to making a final decision.

Throughout the interview, ensure to ask about the way of life bonus that the neighborhood uses. For example, ask if the area has an upkeep team on site, or if the staff is resident-focused. You need to additionally inquire about the food and dining choices used at the community. There need to be a variety of healthy and balanced food choices, including vegan, vegetarian, as well as gluten-free. Assisted living is a good choice for your loved one.

In the process of assessing the expense of assisted living, make sure to contrast rates and benefits. The average regular monthly price of a single system is around $4,300, but if you plan to live longer, think about the distinction in cost. For a single-person assisted living device, this can be as high as 6 times as much. Helped living https://blogfreely.net/kathern1294justin/prior-to-moving-into-an-assisted-living-facility-make-certain-you-recognize have long waiting checklists as well as rigorous criteria. If you do discover a low-cost center, you can still select the appropriate fit for your enjoyed one.

Your enjoyed one may additionally be experiencing sensations of loss and loneliness as they relocate from their home to a senior living facility. Remember, relocating to a new place can be challenging for any person and also it is vital to acknowledge their feelings of loss. Give them time to get used to their brand-new environments and fulfill new staff. Ideally, browse through and also call them commonly to assure them that you are still there for them. You can likewise visit them on a regular basis if you live far.

Regarding eating is worried, an assisted living community uses a variety of choices. Numerous will provide numerous dishes every day, with an option for nutritional restrictions. While independent living communities enable homeowners to prepare their own dishes, aided living neighborhoods offer three dishes daily, usually prepared by a cook. In addition, aided living neighborhoods usually have a larger dining room where locals can rest together as well as participate in mingling. Helped living centers commonly provide extra hrs of setting a day, with smaller sized groups and activities tailored to their capabilities.

While independent living is essential for lots of seniors, some people with significant clinical conditions might need help in particular scenarios. Helped living neighborhoods provide medical solutions as well as guidance. These solutions help seniors live independently, yet might not suffice to satisfy their requirements. Frequently, the support is as simple as routine team check-ins, or a lot more comprehensive help with bathing as well as grooming. If your enjoyed one needs clinical aid, the ideal center will provide this.

While selecting an assisted living area for your senior loved one, be sure to consult your family and friends. If you have any type of issues, seek advice from the center's doctors or staff. It's likewise beneficial to talk to other residents. The community's ambience is necessary. Aided living centers must offer treatment that is both risk-free as well as pleasant. Nonetheless, see to it that the staff are extremely trained as well as knowledgeable about the citizen's condition. If your loved one requires healthcare, they may benefit from an area that is close to the nearby health center.

Aided living facilities use treatment as well as help with day-to-day living activities, however they don't give day-and-night treatment. An assisted living facility is even more of a home-like setting that allows you to remain in a familiar environment without the trouble of cleansing, washing, and also grocery purchasing. Furthermore, transport can be an issue, specifically for people with minimal wheelchair. Aided living centers supply transportation to assist homeowners go out and around. They're an excellent choice for lots of senior citizens.

The National Facility for Assisted Living suggests seeing several assisted living facilities to establish if a certain area is right for your enjoyed one. Checking out throughout https://www.iadvanceseniorcare.com/creative-ideas-for-marketing-senior-care-facilities-during-the-pandemic/ is a great means to satisfy the team and also citizens of the facility. If you have inquiries, make sure to ask. Additionally, do not be reluctant regarding requesting referrals or to see the centers' website. This info is essential to the decision-making procedure. By complying with these pointers, you can ensure that you will obtain a high quality aided living experience.

Among the primary distinctions between assisted living and independent living is the variety of solutions offered. While some assisted living communities offer some medical help, they are not as comprehensive as experienced nursing communities. These are typically developed for senior citizens with an extra serious medical condition. You can anticipate 24-hour care in a proficient nursing area, and there are likewise extra benefits that come with this kind of care. Yet you need to still research your alternatives very carefully prior to making a final decision.

Throughout the interview, ensure to ask about the way of life bonus that the neighborhood uses. For example, ask if the area has an upkeep team on site, or if the staff is resident-focused. You need to additionally inquire about the food and dining choices used at the community. There need to be a variety of healthy and balanced food choices, including vegan, vegetarian, as well as gluten-free. Assisted living is a good choice for your loved one.

In the process of assessing the expense of assisted living, make sure to contrast rates and benefits. The average regular monthly price of a single system is around $4,300, but if you plan to live longer, think about the distinction in cost. For a single-person assisted living device, this can be as high as 6 times as much. Helped living https://blogfreely.net/kathern1294justin/prior-to-moving-into-an-assisted-living-facility-make-certain-you-recognize have long waiting checklists as well as rigorous criteria. If you do discover a low-cost center, you can still select the appropriate fit for your enjoyed one.

Your enjoyed one may additionally be experiencing sensations of loss and loneliness as they relocate from their home to a senior living facility. Remember, relocating to a new place can be challenging for any person and also it is vital to acknowledge their feelings of loss. Give them time to get used to their brand-new environments and fulfill new staff. Ideally, browse through and also call them commonly to assure them that you are still there for them. You can likewise visit them on a regular basis if you live far.